Courage grows together.

Strategy

Our strategy is focused on the customer, improving the customer experience and creating value for all our stakeholders. The three focus

areas are: 1) transformation, 2) growth, and 3) scalability.

Three focus areas of the strategy

1. TRANSFORM

- Streamline customer processes by integrating services to platforms

- Systematically improve all products and processes with AI

- Increase operational agility to speed up time-to-market

2. GROW

- Diversify and build new products and revenue streams

- Develop the best human and technology capabilities

- Accelerate growth through M&A

3. SCALE

- Scale existing assets to create new products and services

- Expand businesses to new geographies

- Leverage synergies through efficient co-operation

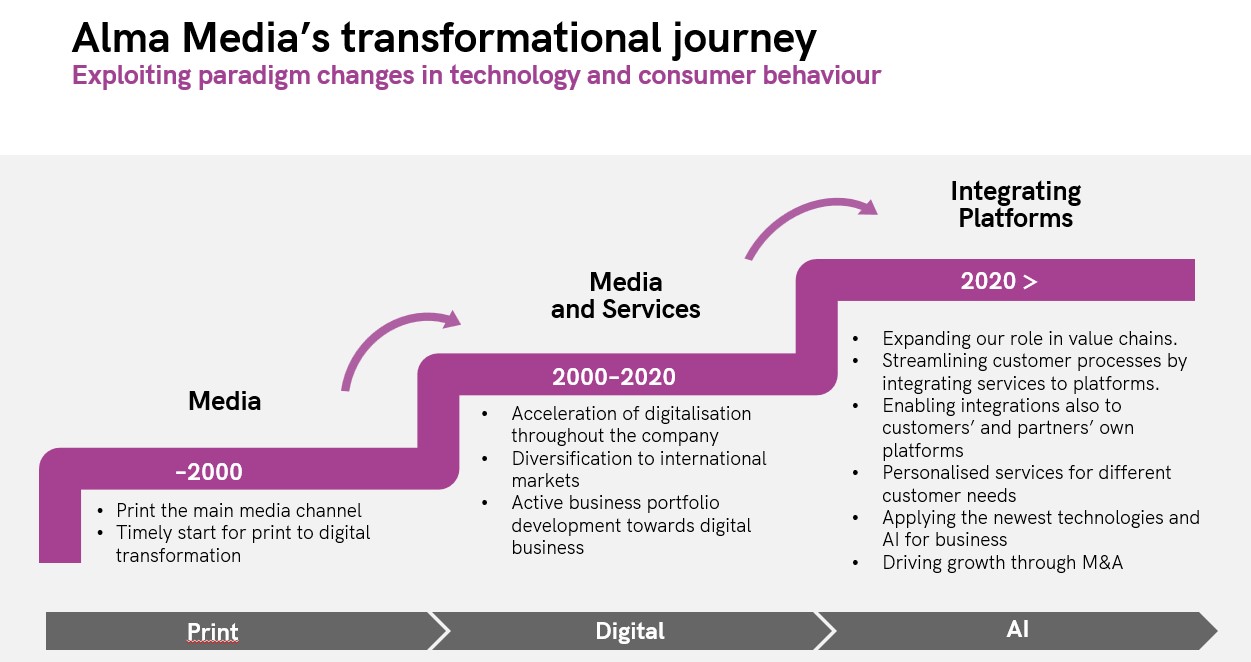

Our transformation from a company reliant on the printed newspaper publishing business to a provider of digital services has been well underway for a long time and investments in digital media and services have been made since the mid-1990s. Alma Media has been transforming the media business since it decided to take the publishing business to the future by turning printed media into digital.

In fact, the first efforts were already seen in the late 1990s in the form of Kauppalehti and Iltalehti websites. At the time, digital business accounted for a few percent of revenue. At the same time, as work on the media revolution began, investments in marketplaces also started. During the transformation trip, the company has had practically the same strategy all the time: translation from print to digital media and media to services, and internationalisation.

In our strategy, we have outlined a comprehensive plan for the development, growth and scaling up of our business

Alma Media continues its strategic transformation of the media and service-providing company towards advanced platform solutions-company in marketplaces, media and information services. Our key business areas are recruitment, mobility, housing and premises, information services and news media. We focus on the businesses where we have the ability to create added value for the end-customer and where the competitive advantage enables us to grow profitably. We combine our own and our customers’ technical and commercial platforms for seamless service packages that improvethe customer experience of our service users and enhance digital processes of our corporate customers, such as sales and purchasing processes in the marketplaces business. We seek growth by supplementing our offering in key businesses’ value chains. We accelerate growth via acquisitions and we will continue the internationalisation of our businesses also in new geographic areas. We develop both technology and knowledge capabilities to enable growth and transformation. The artificial intelligence and audiences are the shared strategic priorities of the Group’s businesses for the strategy period. The rapid development of AI will have a broad impact on our operating environment and business in the future. We will fully leverage the opportunities presented by the latest AI-driven technology and harness AI in our business operations to develop our products and services, increase the efficiency of our processes and streamline the work of our professionals.

It is our goal to support faster time to market for products and build greater agility. Growth of the audience using our services, increase the engagement of the users, registered use of our services, more personalised services are essential for all of our businesses. We pursue synergies through cooperation by, for example, managing traffic between our services to support audience growth; collecting, refining and commercialising data; taking advantage of common technology, platforms, capabilities and functions; and investing in joint media sales in Finland.

Users are increasingly interested in online services and trading, even when it comes to larger household purchases. With the digitalisation of purchasing processes, we are taking a strategic step towards developing our marketplaces from classified advertisement listing services to advanced digital platforms. The goal is to help both our end users and our B2B partners to easily and smoothly interact online, and we also aim to offer additional services at different stages of the transaction process. For example, a consumer can take the car or housing transaction to the end, up to financial arrangements, on new trading platforms. This will require a licence granted to Alma Media in late spring 2023 to handle payment intermediation.

Examples of the advanced new services in the mobility vertical include the digital used car auction service Baana, online documentation and electronic payments in the car trade, and the “Helpot Kaupat” (“Easy transaction”) model that can be used with a smartphone. In the housing vertical, the OviPro solution is a similar example. The DOKS service is a digital tool that helps companies manage anti-money laundering obligations, monitor sanctions and, in general, identify and know their customers.

Since the end of 2021, the Alma Career United project has increased cooperation, as planned, in product development, sales and marketing, harmonised technology and operating models, and built services that are even more internationally competitive. The project aims for stronger synergies in the production of services for corporate customers, as well as the development of recruitment solutions that extend across the borders of our countries of operation. Central to the progress is the harmonisation of technology and service platforms enabling joint product development in the operating countries, as well as the gradual integration of financial, HR and legal processes into the Group’s processes. The Alma Career B2B brand has been launched for corporate customers, also enabling the buying and selling of the entire Alma Career product and service portfolio in all operating countries and across Europe going forward.

Strategy implementation during 2025

The Alma Media has made strong progress in the utilisation of AI in its services in 2025. Significant launches during Q3 included Etuovi.com’s semantic search function, Iltalehti’s AI chat and podcast, an AI system named Sophi for optimising Kauppalehti’s paywall, and AI Moderator for moderation purposes.

On the corporate services side, Edilex AI offers improved searches for legal information, while Teamio and Seduo use AI to produce career-related content. Atmoskop automatically summarises employee feedback, while Autohuuto uses AI to add pros and cons to car listings.

The Career United project, which seeks to strengthen internal cooperation and improve productivity in the Alma Career segment, continued as planned. The renewal of various systems continues in phases, and the transition to cloud services will be completed by the end of 2026. After that, overlapping capacity costs will begin to decrease as planned. The cross-border product organisation has increased efficiency in product development,

enabled the integration of platform systems and improved the management of the product portfolio. As part of the system upgrades, CV databases have been consolidated for the Baltic countries, Czechia, and Slovakia. By the end of the year, the databases for Croatia and Bosnia will also be integrated. This makes it possible for recruiting companies to perform searches on a common CV database that covers seven countries.

The development of AI-based job search technology continued, and the technology already in use in Slovakia was also introduced to job search services in the Baltic countries. During the remainder of the year, the same technology will be deployed in services in Czechia and Croatia as well. Based on user experiences, the new solution has significantly improved the matching of employers and job-seekers.

In Finland, Jobly Vibes, a new video-based summer job search service for young job seekers, was launched. The main product of the Czech start-up company Nelisa s.r.o., acquired at the end of 2024, programmatic recruitment advertising, was integrated into the Czech product portfolio and successfully expanded to the Slovak market. Based on the experience gained, Nelisa’s products will also be introduced to other markets during 2026.

Product and visibility packages are being renewed in various operating countries to better meet recruitment needs in different customer segments.

In the Alma Marketplaces segment, the strategic focus was in Q3 on expanding the offering, renewing services and systems, and leveraging artificial intelligence in both customer solutions and internal processes. In the digital housing services, a consent service for digital share certificates was introduced on the DIAS platform.

Vuokraovi.com was migrated to a shared technology platform with Etuovi.com, and development and customer onboarding continued for the OviPro system. These service upgrades improve performance, customer experience, and data security, supporting the company’s goal to build the most comprehensive digital ecosystem for housing transactions. In commercial real estate, a technology platform renewal was initiated.

The integration of Edilex Lakitieto into the Legal Insights business unit continued. Edilex AI, a generative AI-based service that provides fast, accurate answers to legal questions based on reliable sources, will be expanded with new content modules. Additionally, a partnership program will be introduced for Legal Insights’ legal literature to enable third-party AI platforms to utilise the materials.

An ESG reporting service from Decade of Action Oy was acquired in Q3, which will serve as the foundation for a new service supporting

companies in assessing sustainability and supplier risks. In November 2025, the Climatrix business was acquired from DirectionLab Oy, which provides digital tools for assessing and reporting physical climate risks.

In the Mobility business unit, development focused on the WebSales Cloud system for vehicle sales, modernisation of listing systems, and expansion of data services. Productisation of marketplace services also continued. In the Comparison Services unit, AI-based features were further integrated into services. The offering was expanded through the acquisition of Effortia Oy (including Sähkövertailu.fi, VertaaEnsin.fi, Asuntojenmyynti.fi, and Neliöhinta.fi).

Alma News Media continued developing digital services and strengthened its use of AI across operations in Q3. AI-assisted tools were widely adopted in editorial workflows and content moderation. AI is also used in the Ask Kauppalehti service and the Sophi dynamic paywall, both launched in Kauppalehti during Q3. The Unelmasalkku stock market game was repeated in the autumn. New content concepts were also introduced:

– Kauppalehti Talousaamu: A live daily current affairs program covering the most relevant economic and stock market news.

– Kauppalehti Teknologia: A new content section focusing on digitalisation and artificial intelligence.

Content business development has progressed as planned toward a sustainable digital model based on recurring content revenue in 2025. New

stock listings and strong performance of the Helsinki Stock Exchange have increased interest in investment-related content. The segment’s

digital share rose to 62.8% in Q3.

Read more about Alma Media long-term financial targets.

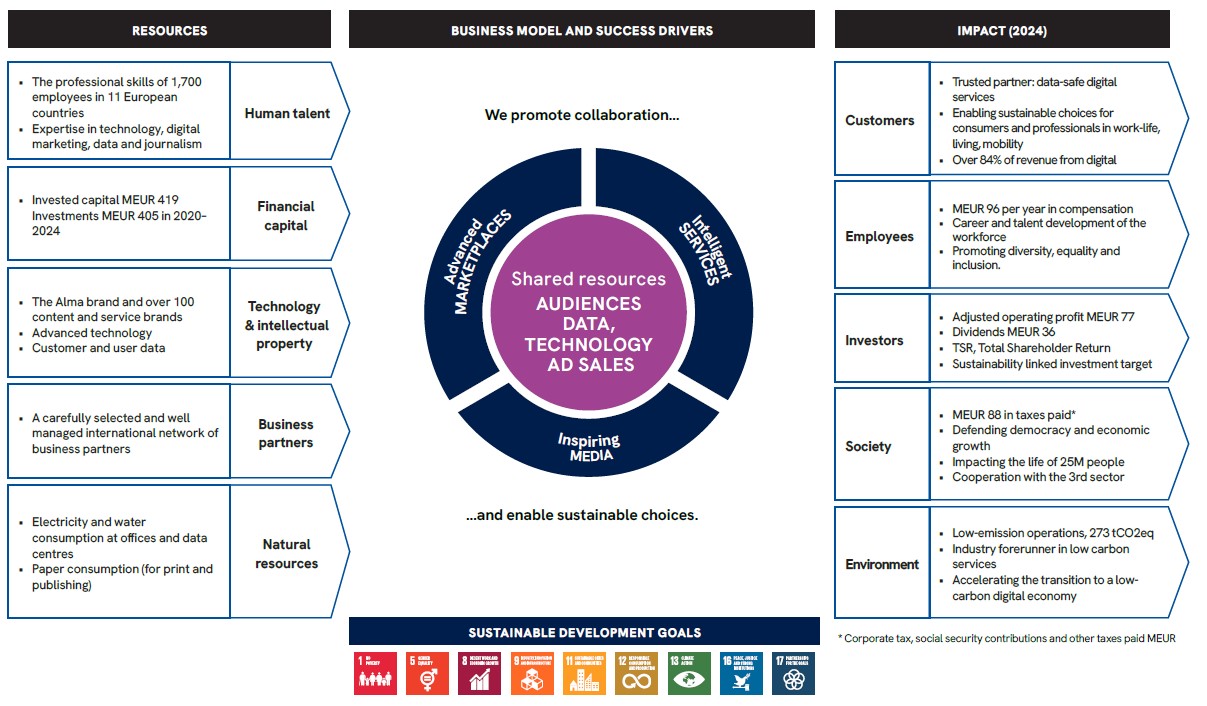

Business model

Alma Media has business operations in three business and reporting segments:

- Ama Career

- Alma Marketplaces

- Alma News Media

Alma Media’s sources of revenue are:

- classified advertising,

- advertising,

- digital services,

- content,

- other sales.

The revenue categories listed above comprise several different revenue generating models. The media sector’s historically clear division between circulation sales and advertising sales has become diversified as a result of digitisation.

Description of the business model

As the digital transformation has progressed, digital marketplaces have become an increasingly significant area of Alma Media’s business. They include services related to recruitment, housing, cars and mobility, for example. The customers of Alma Media’s digital services include both companies and consumers. The digital services business model is based on customer fees charged for classified advertising, fees for increased visibility in classified advertising, service sales, revenue streams from service content and/or advertising targeted at the users of the service, subscription fees and licence fees for the use of information systems.

The media business includes, for example, the professional and financial media and books as well as the national multichannel media Iltalehti. The media business is based on a relationship with readers built through content. As media develops, the reader relationship is shaped into a multidimensional customer relationship with a media brand. The strength of this relationship can vary from occasional visitors or buyers of single copies to the use of online services as registered users of online services, paying consumers of digital content and long-term subscribers of print publications.

The Group’s other services include information services as well as training, event and direct marketing business.

For all businesses, readers and online visitors constitute target groups that are characteristic to each brand. These target groups are the basis for advertising sales. These target group contacts are sold to advertisers on a brand-specific basis and as audience segments from the digital Alma network. For advertisers, this opens up valuable opportunities to specifically target the businesses, professionals, decision-makers, entrepreneurs or consumers that are relevant to the growth of their business. The use of data, analytics and machine learning plays an increasingly important role in improving the product and service offering for advertisers and enriching the end-user service experience. Data and marketing automation enable the provision of increasingly high-quality, effective and impactful solutions to advertisers.

Brand appeal and the communications and marketing efforts aimed at maintaining it are crucial in the digital environment. Alma Media’s services are the best-known brands in their segments in Finland and the Group’s operating countries in Eastern Central Europe. The popularity of these services among users is based on a high level of usability, unique content and, in many cases, the importance of the social or communal dimension. It is also essential to have the ability to respond to customer needs by delivering localised products and services.

Value creation

In Alma Media’s value creation for customers, shareholders and society, the key roles are played by the strong journalism, marketing and technology expertise of the Group’s employees, strong product and service brands, customer data, the best partners, an efficient production and delivery network and a stable financial position. These are described in more detail in value creation model.